At the 31st Nigerian Economic Summit, Power Minister Adebayo Adelabu disclosed that the president’s approval forms part of a financial-stabilisation plan to end decades-long liquidity crises in the sector. The ₦4 trillion instrument, he said, would settle verified invoices of generation companies and gas suppliers and restore balance to the electricity value chain.

“To stabilise the market, Mr President has approved a ₦4 trillion bond to clear verified GenCo and gas-supply debts,” Adelabu announced. “A targeted subsidy will protect vulnerable households while ensuring commercial viability.”

⚡️ QUICK SNAPSHOT —

THE POWER RESET AT A GLANCE

- ₦4 trillion bond to settle GenCos and gas-supplier arrears.

- Sector revenue up 70 percent in 2024; projected ₦2 trillion for 2025.

- 7000 MW grid-expansion plan under Siemens and Power China agreements.

- Reform expected to restore investor confidence and attract new capital.

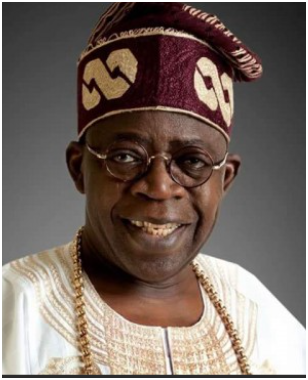

- Supports Tinubu’s target of a ₦1 trillion-GDP economy by 2030.

POLICY UNFOLDING

Adelabu explained that tariff reforms—particularly cost-reflective rates for select consumers—have already lifted sector revenue from ₦1 trillion in 2023 to ₦1.7 trillion in 2024. With the new bond, the government hopes to clear liquidity bottlenecks, incentivise private investment, and revive dormant generation capacity.

He added that contracts under the Presidential Power Initiative would inject 7,000 megawatts of additional transmission strength, while the rehabilitation of the Zungeru Hydropower Plant and NIPP projects would unlock a further 345 MW.

OUTCOME

Industry analysts told IDNN the debt clearance could mark the sector’s turning point: “Once the backlog is gone, power producers regain creditworthiness and can raise capital again,” said energy economist Dr Abiola Kareem. He noted that timely settlement will curb generation disruptions and improve grid reliability.

Officials from the Debt Management Office confirmed discussions to securitise the instrument before year-end, ensuring transparent repayment schedules through government bonds.

NEXT RIPPLE

The initiative dovetails with the Renewed Hope Agenda’s drive for fiscal consolidation and industrial competitiveness. Economic analysts see the bond as a bridge between Tinubu’s power-sector rescue and the broader 2026–2030 National Development Plan, which targets sustainable energy access and manufacturing growth.

This is IDNN. Independent. Digital. Uncompromising.