⚙️ The Numbers Behind the Boast

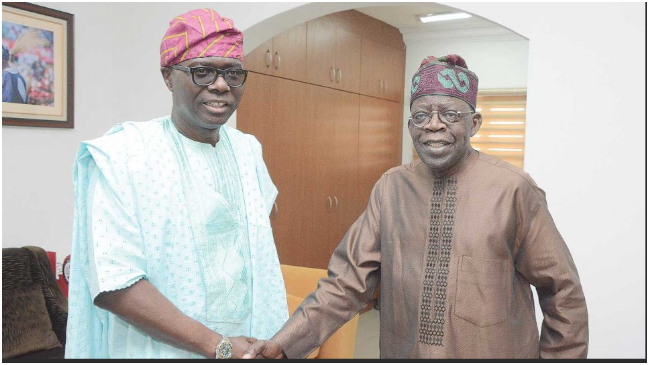

Addressing the South-West Governors’ Economic Roundtable in Lagos, Sanwo-Olu declared that the federation account now delivers “more liquidity than any period in the last decade.”

According to FAAC’s October bulletin, total distributable revenue hit ₦1.87 trillion, with states receiving ₦619 billion — up from ₦381 billion in October 2024.

“Every state now has oxygen,” he said. “What you do with it will define your legacy.”

🧾 Tinubu’s Fiscal Reset — How It Works

Analysts credit the rebound to Tinubu’s Fiscal Responsibility and Revenue Harmonisation Plan, launched in Q1 2025.

The plan merged multiple remittance streams — oil royalties, solid-mineral dues, customs, and VAT — into a single Revenue Performance Framework (RPF).

Key reforms include:

- Raising state VAT share from 50% to 55%, with LGAs gaining 35%.

- Clearing ₦700 billion in oil-derivation arrears owed to Niger Delta states.

- Redirecting federal IGR to an electronic Treasury Single Account-2.0 for transparency.

“The president understands that economic stability begins at the subnational level,” said economist Ifeanyi Adefarasin.

🧭 Gains and Gripes

- Governors’ Windfall: Monthly allocations up 62% on average.

- Public Scrutiny: Civil groups call for “performance audits” on increased inflows.

- Revenue Boards: Report VAT compliance jump of 37% in Lagos, Rivers, and Kano.

- Labour Concerns: Workers urge wage review to match state liquidity surge.

Yet, some fiscal watchers warn the buoyancy may be temporary if crude benchmarks dip below $80 per barrel.

⚖️ Federalism or Fiscal Dependency?

Critics argue that while Tinubu’s policy improves liquidity, it entrenches dependence on the centre.

Development economist Dr. Nnanna Iroegbu told IDNN.news:

“It’s paradoxical — states are richer but still reliant. Fiscal federalism means self-generation, not bigger cheques from Abuja.”

Others counter that the reforms buy governors breathing space to invest in internal revenue infrastructure.

💼 Who Gains What

- Top Beneficiaries: Lagos, Rivers, Delta, Akwa Ibom Kano.

- Mid-Tier Risers: Ekiti, Niger, and Bauchi see record inflows.

- Private Sector: Contractors report faster payments as cash circulates.

Financial analysts note that FAAC’s new transparency dashboard could attract development finance and credit rating upgrades if sustained.

🎬 Money Talks, Performance Waits

For Tinubu, the fiscal flood is proof of reform working.

For governors, it’s a mirror.

Nigeria’s challenge is no longer who has money — it’s who has management.

This is IDNN.news — Independent. Digital. Uncompromising.