A regulatory spotlight turns

When Nigeria opens probe into Temu, the scrutiny extends beyond a single platform. It signals the regulator’s willingness to test compliance standards in a rapidly expanding digital marketplace.

The Nigeria Data Protection Commission (NDPC) announced that it has commenced an investigation into the Chinese-owned e-commerce platform over suspected violations of Nigeria’s data protection framework.

Surveillance and cross-border concerns

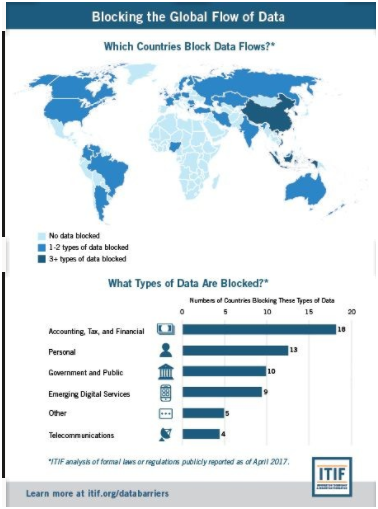

The NDPC said the probe was triggered by concerns relating to online surveillance practices, opaque data handling, cross-border transfers and potential breaches of data minimisation requirements.

Commissioner Vincent Olatunji ordered the investigation, warning that processors found non-compliant could face sanctions under Nigeria’s data protection regime.

Temu handles the personal data of millions of Nigerian users, according to regulatory estimates.

A platform under global scrutiny

Temu, owned by Nasdaq-listed PDD Holdings, has expanded aggressively in Nigeria with app-driven discount offerings across fashion, electronics and household goods.

Globally, the company has faced increasing regulatory attention as jurisdictions examine how data is collected, stored and processed.

The company did not immediately respond to requests for comment following the Nigerian announcement.

Enforcement precedents matter

Nigeria’s data watchdog has previously imposed financial penalties on firms found in breach of data protection obligations.

Last year, a major pay-TV operator was fined hundreds of millions of naira for non-compliance, underscoring the regulator’s enforcement intent.

The Temu investigation therefore sits within a broader enforcement trajectory rather than an isolated action.

The system beneath digital expansion

Nigeria’s data protection framework requires companies processing personal data to adhere to principles of lawful basis, transparency, purpose limitation and minimisation.

Cross-border transfers must meet adequacy and safeguard requirements. Platforms operating at scale are expected to implement robust consent, retention and security protocols.

As Nigeria’s digital economy expands, regulatory oversight is intensifying in parallel.

If violations are established

Should breaches be confirmed, the outcome could include fines, compliance directives or operational adjustments within Nigeria’s market.

If the platform is cleared, the investigation may still reinforce regulatory expectations for multinational digital operators.

For now, the probe marks another step in Nigeria’s evolving digital governance landscape — where market growth increasingly meets regulatory guardrails.

This is IDNN. Independent. Digital. Uncompromising.