By IDNN Economy Desk

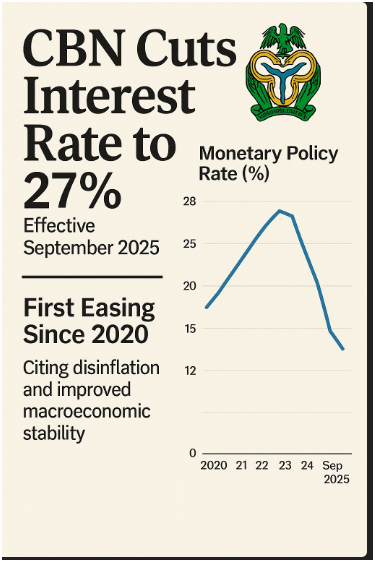

The Central Bank of Nigeria has lowered its Monetary Policy Rate (MPR) to 27%, cutting by 50 basis points in the first easing since 2020.

Governor Olayemi Cardoso said the decision followed five straight months of disinflation, as headline inflation dropped to 20.12% in August.

However, members of the Organised Private Sector (OPS) said the relief remains marginal. “Borrowing costs are still far too high for SMEs and manufacturers,” one OPS leader told IDNN.

Why Businesses Are Skeptical

OPS argues that with banks still pricing credit at 30% and above, the rate cut has yet to touch the real economy. Nigeria’s inflation, though falling, remains among Africa’s highest, while fragile consumer demand compounds the pressure on firms.

Implications for Growth

Analysts say the cut may encourage investment, but unless further easing follows, firms will continue to struggle. OPS has urged the CBN to deepen reforms and expand access to affordable credit for the productive sector.

This is IDNN. Independent. Digital. Uncompromising.