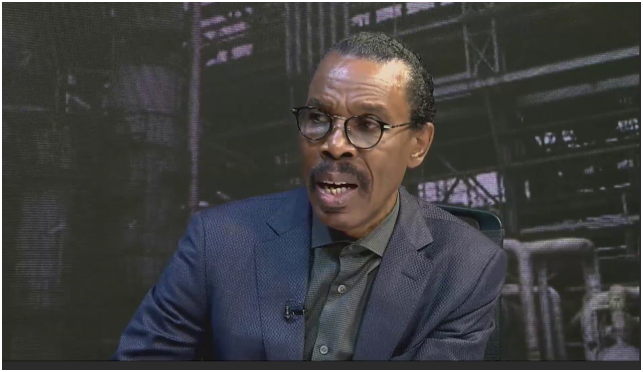

Chief Executive Officer of Financial Derivatives Company Limited, Bismarck Rewane, has projected that inflation averaging 16% will shape Nigeria’s economic environment in 2026, pointing to structural adjustments in inflation measurement and persistent pressure from foreign exchange and debt obligations.

Rewane made the projection while presenting the 2026 economic outlook at a forum organised by the Association of Corporate Treasurers of Nigeria, where he noted that recent inflation moderation should be viewed with caution.

According to him, the introduction of a new Consumer Price Index methodology created a base-year correction effect that partly explains the sharp drop in headline inflation, rather than a broad easing of underlying price pressures.

Inflation averaging 16% reflects structural pressures

Rewane explained that while some macroeconomic indicators have stabilised, inflation risks remain elevated due to exchange rate dynamics, debt servicing obligations and cost pass-through from imports.

He noted that the naira has weakened significantly over the past decade, falling from about ₦190 to the dollar in 2015 to around ₦1,430 in early 2026, adding that repayment and debt service demands continue to place pressure on foreign exchange liquidity.

The economist said Nigeria’s trade balance has improved in recent years, accounting for about six per cent of gross domestic product, supported by export growth. However, he warned that oil price volatility still poses fiscal risks, with each decline in oil prices translating into wider budget deficits.

08112935565, 08161558757

FX outlook and treasury implications

On the foreign exchange outlook, Rewane said the naira appears relatively stable but remains weakly anchored, with projections suggesting potential depreciation pressures over the medium term.

He urged corporate treasurers to move from defensive cash hoarding to more strategic liquidity management, including improved timing of foreign exchange conversion, stronger use of hedging instruments and closer alignment between treasury operations and business planning.

According to him, better liquidity planning could enhance cash flow predictability and reduce exposure to currency risk in an uncertain macroeconomic environment.

Policy caution amid fragile stability

Rewane stressed that stability should be seen as a tool rather than an endpoint, warning that inflation risks could resurface if structural reforms are not sustained.

He advised policymakers and businesses to remain cautious, noting that while recent data points offer some reassurance, underlying vulnerabilities in inflation, exchange rates and public finance persist.

This is IDNN. Independent. Digital. Uncompromising.