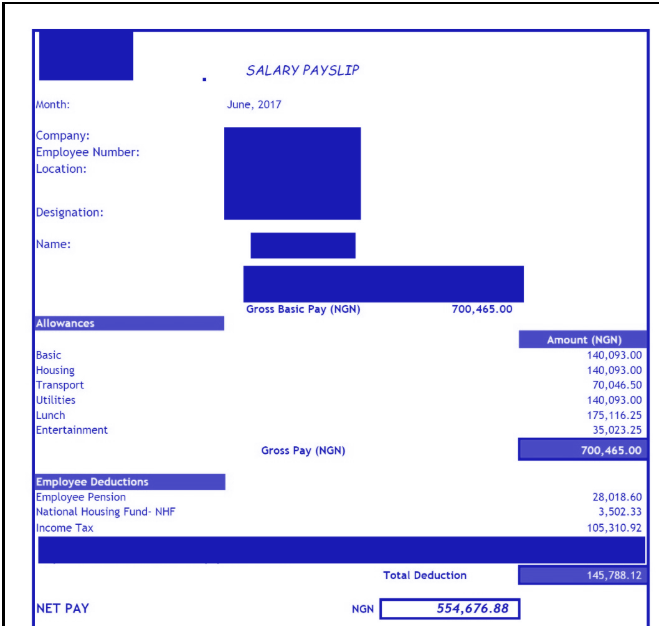

Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, has said PAYE cuts take-home pay higher for Nigerian workers under the newly implemented tax laws, citing early feedback from employees who have received their January 2026 salaries.

In a statement shared on social media, Oyedele said initial indications show that reductions in Pay As You Earn deductions have translated into increased net income for many salary earners, particularly those whose taxes are deducted at source by employers.

“We are pleased to note the feedback from workers who have received their salaries for January 2026 and confirmed a reduction in their PAYE tax, resulting in higher take-home pay under the new tax laws,” Oyedele said.

PAYE cuts take-home pay amid mixed reactions

Oyedele acknowledged that reactions to the reforms have been mixed, with some workers reporting minimal changes or no noticeable difference in their net earnings. He attributed these variations to differences in income levels, payroll structures, and the pace of implementation by employers.

Under the revised tax framework, income up to ₦800,000 annually is exempt from personal income tax, while progressive rates apply beyond that threshold. The reforms are designed to reduce the tax burden on low- and middle-income earners while simplifying tax administration.

Engagement planned to address implementation gaps

To address concerns and ensure uniform application of the new rules, Oyedele said the committee, in collaboration with the Joint Revenue Board, will hold an engagement session with key stakeholders involved in payroll management.

The session will involve human resources directors, payroll managers, chief financial officers, tax managers and other senior executives responsible for tax compliance, with a focus on clarifying the correct application of the Personal Income Tax provisions.

According to Oyedele, the engagement is aimed at ensuring that workers fully benefit from the reforms while employers remain compliant with the updated legal framework.

Reforms positioned as part of broader tax overhaul

The PAYE adjustments form part of a wider tax reform agenda anchored on the Nigerian Tax Act and the Nigerian Tax Administration Act, which took effect in January. The government says the reforms are intended to improve disposable income, reduce multiple taxation and enhance efficiency in tax collection.

Oyedele has previously stated that about 98 per cent of Nigerian workers are expected to either pay no PAYE tax or pay less under the new framework, while most small businesses will also be exempt from key federal taxes.

08112935565, 08161558757

Despite assurances from government officials, labour groups and policy analysts have urged close monitoring of the reforms’ impact, noting that sustained benefits will depend on inflation control and consistent enforcement across organisations.

This is IDNN. Independent. Digital. Uncompromising.