THE SYSTEM HACK: HOW CREDICORP IS REWRITING NIGERIA’S CONSUMER ECONOMY

By IDNN Economy & Reform Desk

For decades, Nigeria’s economy has punished ambition. From cars and furniture to rent and school fees, the rule was simple: cash now, or nothing later.

But a radical new player—Credicorp—is rewriting that rule, and possibly reshaping the foundation of Nigeria’s middle-class aspirations.

This is not a loan scheme. It is a system hack: a structural bet that Nigerians, when given access to smart credit, will unlock new levels of productivity, dignity, and economic fluidity.

“We’re not handing out money. We’re engineering dignity,” said Uzoma Nwagba, Managing Director of the Consumer Credit Corporation of Nigeria (Credicorp).

💸 GOODBYE CASH-AND-CARRY, HELLO CREDIT ECOSYSTEM

In most developed countries, consumer credit powers everything from retail to real estate. You don’t save for years to buy a car or a couch—you pay monthly, with dignity and planning.

In Nigeria, however, the absence of a functioning credit system has created a distorted consumer culture. People delay urgent needs, overstretch income, or fall prey to loan sharks.

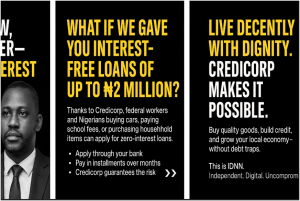

Credicorp’s initiative aims to change that:

-

Up to ₦2 million interest-free

-

No direct lending—banks, cooperatives, and fintechs do the heavy lifting

-

The catch? Credicorp guarantees the risk and enables the structure

🧱 A STRUCTURE, NOT A STIMULUS

This isn’t another palliative. The model is inspired by credit systems in South Korea, Kenya, and the U.S., but tailored for Nigeria’s fragmented financial space.

“This is industrial policy disguised as consumer empowerment,” says a senior official at the Central Bank.

Rather than flooding the market with cash, Credicorp is creating a national credit scoring architecture—linked to NINs, monitored by credit bureaus, and governed by transparency rules.

🛒 WHAT NIGERIANS CAN DO NOW THAT THEY COULDN’T

The dream is deceptively simple:

-

Buy a ₦2 million tricycle and pay ₦100,000 per month

-

Pay your children’s school fees in three parts, not one

-

Purchase a solar generator or kitchen set, and split payments over a year

For civil servants, traders, artisans, and young professionals, this isn’t just credit. It’s a new class passport—a shift from hand-to-mouth existence to long-term planning.

⚙️ WHY THIS IS A SYSTEM HACK, NOT A FLUKE

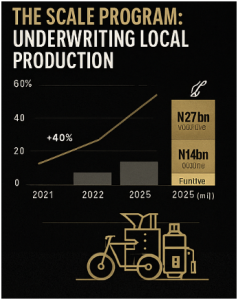

Credicorp isn’t just offering credit. It’s targeting how Nigerians spend, what they buy, and who produces it. Enter the SCALE program—Securing Consumer Access to Local Enterprise.

Manufacturers that increase local content (like solar kits or furniture) get access to more customers via Credicorp’s credit pipeline.

“If your company builds more of it locally, your buyers pay less interest. That’s our value chain pressure,” Nwagba revealed.

Already, TVS tricycles, Nigerian-made solar panels, and local furniture cooperatives are onboard. More are joining.

🧠 CULTURE SHIFT, NOT JUST CAPITAL

The bigger challenge? Changing how Nigerians think about credit.

From religious suspicion to generational trauma from MMM scams, many still see credit as a trap—not a tool.

That’s why Credicorp is working with fintechs, faith groups, and digital banks to launch a financial literacy blitz. Not to sell loans, but to reset the mindset.

THE REAL TEST: FRAUD, DEFAULT, AND SCALE

Can it work? Only if:

-

Credit scoring becomes trustworthy

-

Fraud is minimized through tech

-

Lenders remain motivated by risk-sharing

Nwagba acknowledges the risks, but insists:

“This is not about giving people free money. It’s about building the systems we’ve always lacked.”

🧨 This is IDNN. Independent. Digital. Uncompromising.