President Bola Tinubu has approved a 15 percent import duty on petrol and diesel, a measure the government says will protect local refineries and align import prices with domestic production costs.

The policy, detailed in a 21 October letter to the Attorney-General and energy regulators, follows recommendations by FIRS Chairman Zacch Adedeji to create a “market-responsive import-tariff framework.”

Government projections indicate an extra ₦99.72 per litre in landing cost — roughly ₦1.9 billion daily in new revenue — while keeping Lagos pump prices near ₦965, below West African averages.

But marketers are unconvinced.

“As it is, the price of fuel may go above ₦1,000 per litre,” a depot operator told IDNN.

Independent Petroleum Marketers Vice-President Hammed Fashola said the policy “has both positive and negative effects”—it could spur refining but risk monopoly and scarcity if domestic output fails.

Energy analysts warn that without price-stabilisation mechanisms, the duty could erode consumer purchasing power and distort competition, especially as the five-percent fuel surcharge takes effect in January 2026.

Policy versus Pain

Public reaction has been fierce. Critics like APC chieftain Ayiri Emami argue the tariff will “hurt ordinary Nigerians, not marketers,” while supporters hail it as a bold step toward energy self-reliance and naira-denominated trade.

The NMDPRA says it will enforce the directive once formal notice arrives, insisting that deregulation remains intact and competition—not regulation—will decide final prices.

Impact Snapshots

- Refining Reform: Dangote and modular plants in Edo, Rivers and Imo gain protection against cheap imports.

- FX Relief: Import substitution expected to ease dollar demand and strengthen the naira.

- Inflation Risk: Short-term retail surge likely to pressure transport and food indices.

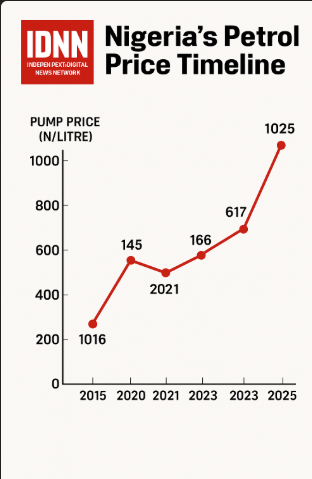

Fuel price timeline (2015 → 2025)

- 18 Jan 2015 — ₦87/litre (Jonathan reduced ₦97→₦87; starting point carried into early Buhari). Vanguard News

- 11 May 2016 — ₦145/litre (FG announced hike to ₦145). TheCable

- 19 Mar 2020 — ₦125/litre (COVID-19 oil crash; PPPRA/FG cut price). Premium Times Nigeria

- 1 Apr 2020 — ₦123.50/litre (further monthly template cut). thisdaylive.com

- 2 Sept 2020 — ₦151.56/litre (PPMC/NNPC upward review). Vanguard News

- 14 Dec 2020 — ₦162.44/litre (post-labour talks adjustment; many stations sold ₦162–₦165). proshare.co

- Feb 2021 — ₦166.24/litre (avg) (NBS national average). nigerianstat.gov.ng

- 31 May–1 Jun 2023 — ₦488–₦557/litre (NNPCL table after subsidy removal). thisdaylive.com

- 18–19 Jul 2023 — ₦617/litre (Abuja); ~₦568 (Lagos) (further price revision at NNPC outlets). Premium Times Nigeria

- 30 Oct 2025 — ~₦928/litre nationwide average reported; govt adds 15% import duty (likely +~₦99/l). Reuters

- Marketers warn prices could exceed ₦1,000/litre as the duty takes effect (plus separate 5% surcharge slated for 2026). Punch News

Commercial Tag

Analysts forecast renewed investor interest in domestic storage, logistics, and midstream infrastructure — a critical front for energy-sector sponsors seeking hedged returns amid policy volatility.

This is IDNN. Independent. Digital. Uncompromising.