Nigeria’s inflation rate eased again in September 2025, falling to 18.02 % year-on-year from 20.12 % in August, according to new figures released by the National Bureau of Statistics (NBS).

It marks the sixth consecutive month of moderation, buoyed by improved food supply and stronger harvests that softened the rise in household prices. Food inflation slowed to 16.87 %, while core inflation remained sticky around 19.3 %, reflecting persistent energy and transport costs.

In a coordinated response, the Central Bank of Nigeria (CBN) announced its first interest rate cut in five years, trimming the Monetary Policy Rate (MPR) by 25 basis points to 26.75 %, signalling a cautious shift from the tight monetary stance adopted since the 2022 inflation crisis.

“The moderation in headline inflation provides a credible window for easing without derailing macro-stability,” said CBN Governor Olayemi Cardoso during a post-MPC briefing.

Financial analysts, however, warned that the structural roots of Nigeria’s inflation—high logistics costs, fuel price volatility, and exchange-rate fragility—remain unresolved.

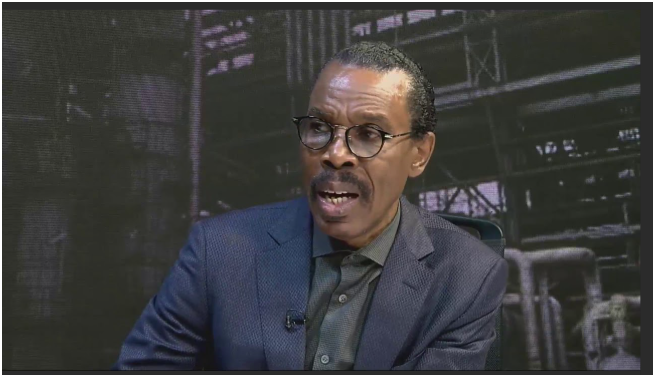

Economist Bismarck Rewane, CEO of Financial Derivatives Company, projected that inflation could drop further to around 18 % in November, citing increased imports to meet pre-holiday demand and improved forex liquidity.

He noted that Nigeria’s Q2 GDP growth of 4.23 %, the highest since 2021, shows “authentic recovery,” but cautioned that falling global oil prices—now hovering around $63.60 per barrel—could erode fiscal revenues.

“At $60 per barrel, the fiscal deficit could climb to 4.5–5 % of GDP,” Rewane warned.

The economist urged fiscal discipline and cost-cutting in governance to sustain recovery, noting that the cost of governance has ballooned from ₦27.7 billion in 1998 to ₦54.9 trillion in 2025, crowding out capital investment.

The CBN’s latest move, analysts say, aims to spur credit and stimulate investment while managing inflation expectations. Yet, the success of that strategy will depend heavily on Nigeria’s ability to stabilise its fuel market, sustain food supply, and tame exchange-rate pressures.

For millions of Nigerians battling rising costs, the latest figures offer a faint relief, but not yet a transformation.